This blog will explore the exciting capabilities of a uniquely designed Google Sheets debt payoff tracker. This tracker is easy to use and intended for year-round utility, allowing you to visualize all your debts on a single page.

If you're interested in purchasing this template, here's the link. This tracker comes in multiple color schemes for aesthetic purposes, including monochrome and multi-colored options, where each color represents a specific debt.

An Overview of the Debt Payoff Tracker

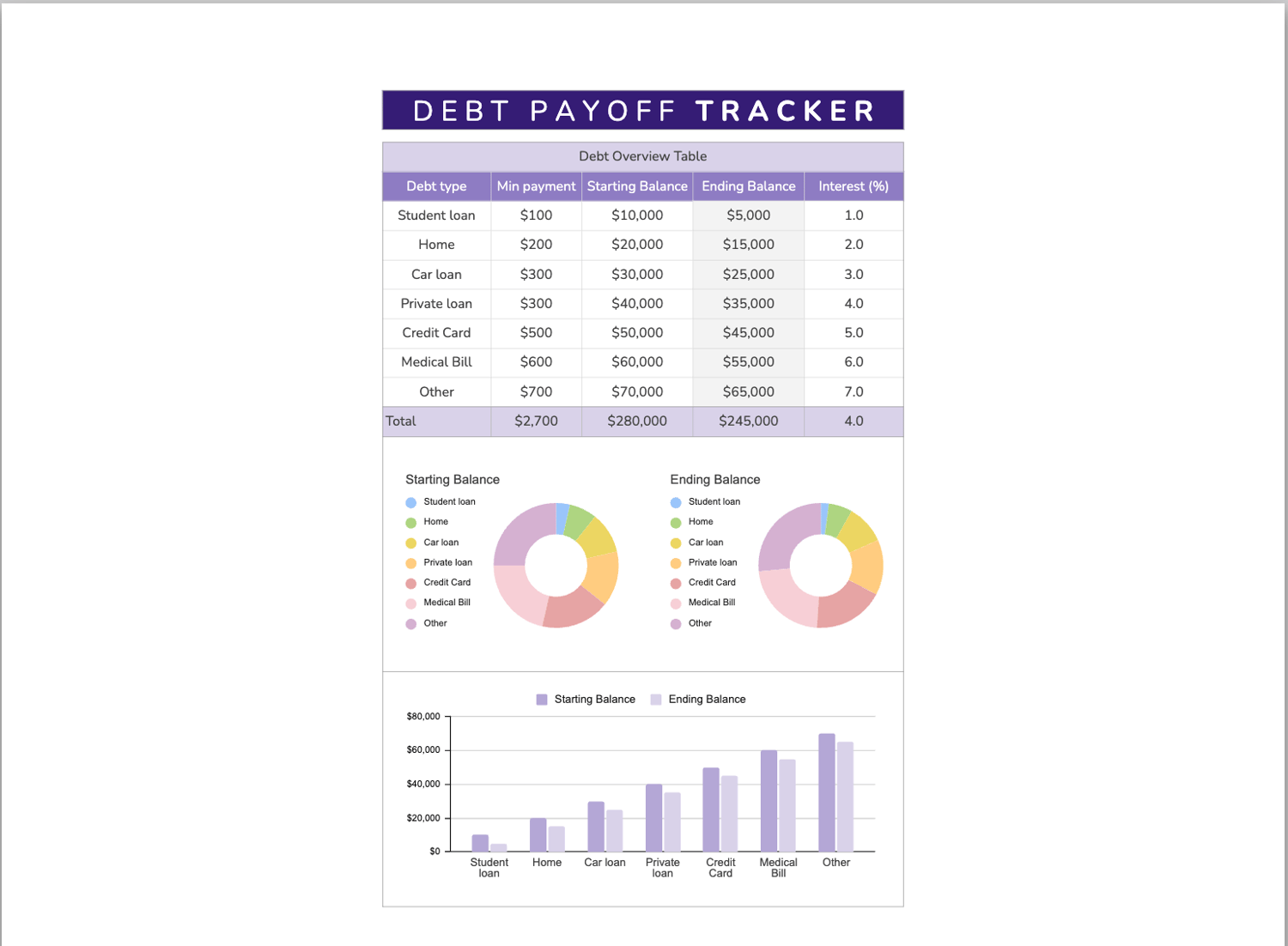

The tracker begins with an overview of your debts, including the types of debt, minimum monthly payments, starting balances, ending balances, and interest rates. Besides this comprehensive table, pie charts provide a breakdown of different debts, making it easier to visualize each debt's weight.

Keeping Track of Your Debt Progress

Following the overview, a graph shows your starting balance adjacent to your ending balance. This side-by-side comparison enables a quick assessment of your debt situation for each type of debt you carry.

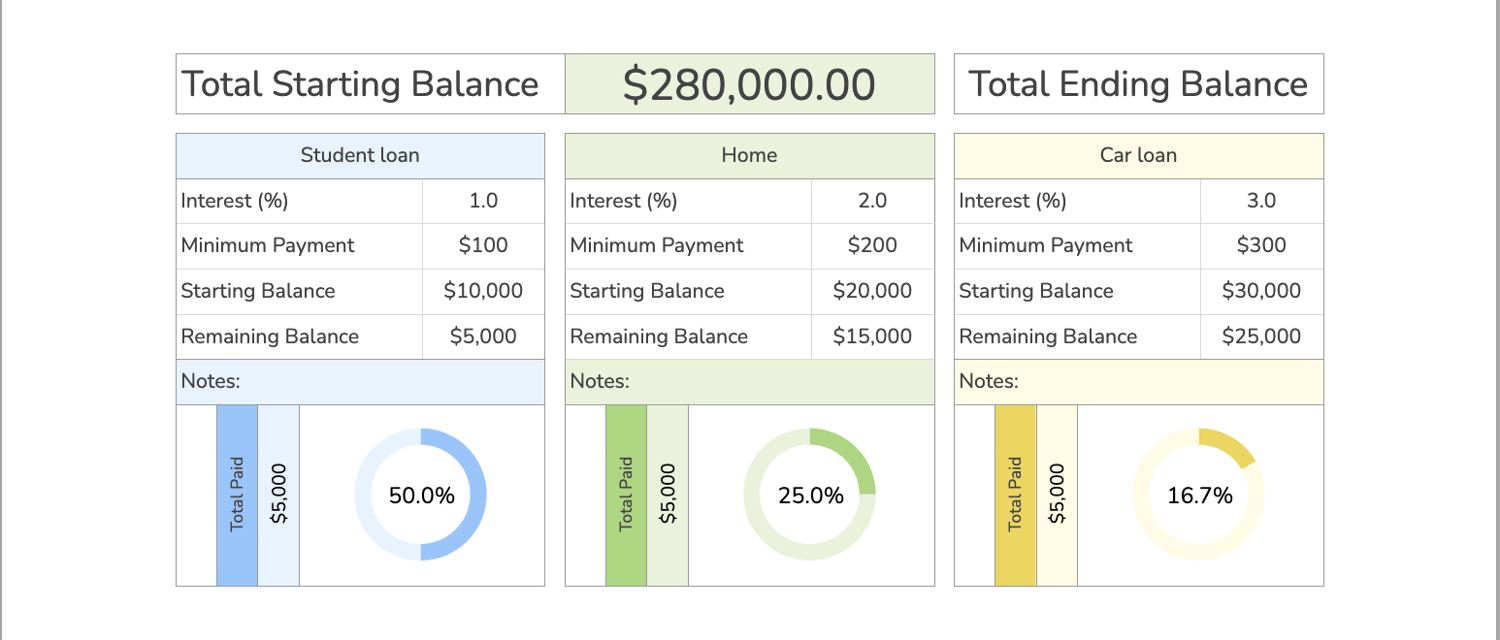

Additionally, the tracker offers a detailed insight into how much of your total debt you've paid off and your progress percentage. Once you've paid off at least 50% of your debt, this section turns green, providing visually positive encouragement.

Customizing the Tracker to Your Needs

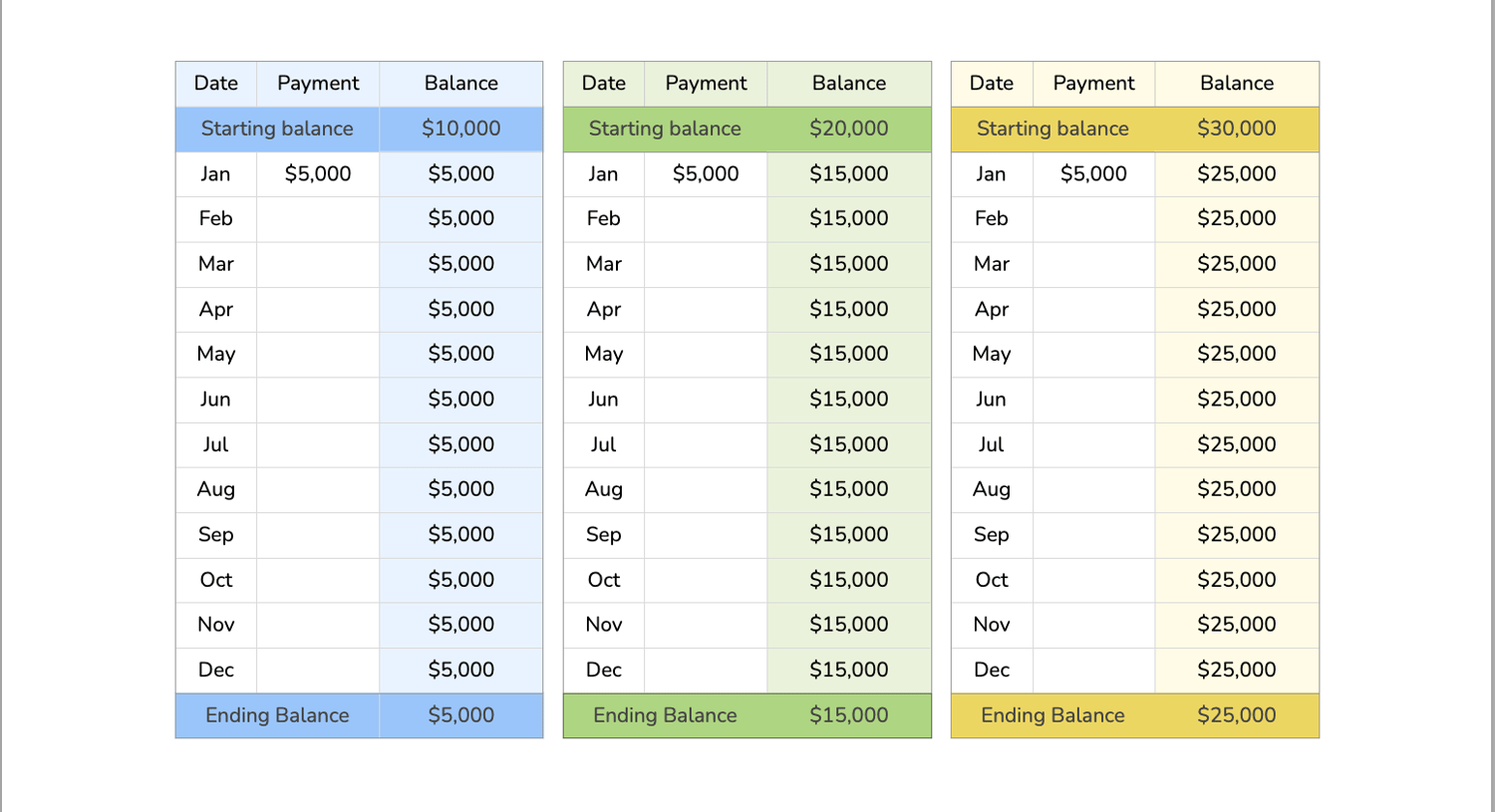

Each specific debt has its section, allowing you to name it whatever you want, whether it's a mortgage, student loan, car loan, or credit card debt. These sections comprise the interest, minimum payments, and starting and ending balances, along with a graph representing the starting and ending balances. A table also represents the amount paid off each month for each debt type.

Setting Up Your Debt Payoff Tracker

Upon first access, you'll encounter a blank template. Let's take a brief walkthrough on how to start from a blank debt payoff tracker:

- Add your debts: Initially, you should input the different debts you owe. Once you update the debt type, it will automatically reflect across the tracker, saving you the time and hassle of updating it in various sections.

- Input the minimum payments: Next, fill out the minimum payment due for each debt. This information will automatically update in the individual debt areas.

- Enter the starting balances: After you've added the starting balance for each debt type, the remaining balance and the ending balance will automatically update.

- Add the interest rates: Finally, input the interest rates for each debt.

Upon completing this setup, the only task is updating your monthly payments. As you make payments, the ending balance will automatically adjust, providing an updated snapshot of your remaining debt. Simultaneously, the tracker will calculate the total paid off and update the graphs to reflect your progress.

Conclusion

This Google Sheets Debt Payoff Tracker is a potent tool for managing your debts efficiently. Whether you decide to purchase this spreadsheet or create your own, you can stay on top of your financial obligations and visualize your progress toward being debt-free.

If you have any questions about setting up your tracker or the formulas used in this tracker, feel free to leave a comment below.